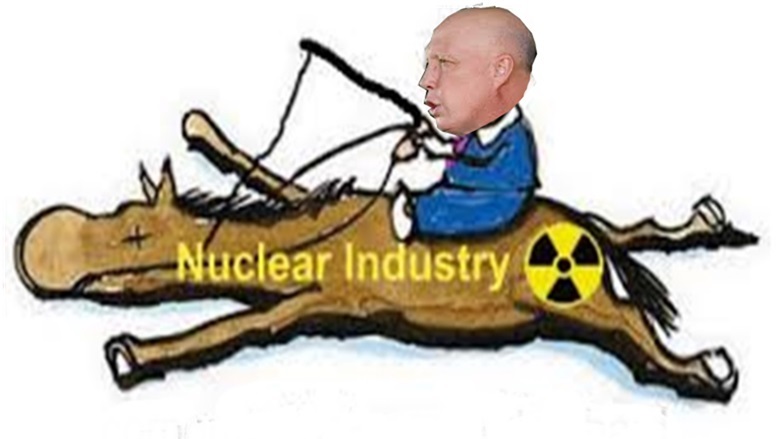

Too uncertain, too slow: funds rule out financing Dutton nuclear plan

The investment bosses of half a dozen funds also agreed there was not enough policy certainty to justify any serious consideration of nuclear energy investments.

In a public consultation paper released in May, the groups proposed excluding nuclear power as a sustainable investment option under the taxonomy as its development is currently illegal in Australia.

AFR, Hannah Wootton 7 July 24

Investment chiefs from the country’s biggest superannuation funds will not bankroll Opposition Leader Peter Dutton’s nuclear power plan, despite strong appetite for other energy transition assets and a shortage of domestic investment opportunities.

Aware Super CIO Damian Graham said the production timelines on nuclear were too long to help meet the fund’s own net-zero targets. His counterpart at UniSuper, John Pearce, said nuclear investments would not make money for members fast enough, while Cbus ruled it out completely.

The investment bosses of half a dozen funds also agreed there was not enough policy certainty to justify any serious consideration of nuclear energy investments.

Broader appetite for private investment in nuclear has been low, with Mr Dutton conceding his scheme will need to be publicly funded despite the Liberal Party’s historic dislike of state-owned energy.

Funds’ dismissal of nuclear also comes as they pour billions of dollars into renewables, and Treasurer Jim Chalmers calls on the $3.6 trillion sector to deploy some of its ever-growing asset pool into “nation building” areas like the energy transition.

“The main reason [we won’t] is the payback time is way too long for us – we’re talking decades, not just years,” Mr Pearce said on possible investments in nuclear.

“We know that nuclear is proven, scalable technology, and you’ve got your ESG considerations as well as economic, but from that economic side, it just doesn’t stack up [as an investment] for a super fund for us.”

Cbus’ CIO Brett Chatfield said: “We don’t see nuclear as a part of the energy transition going forward.”

Cbus, which is chaired by former Labor treasurer Wayne Swan, has been the biggest backer of “nation building” projects to date, including as the only super fund to invest in the government’s controversial Housing Australia Future Fund.

But Mr Chatfield said the fund was “much more focused on the renewable area, particularly onshore and offshore wind and solar” when it came to supporting the energy transition.

Too slow

For Mr Graham, nuclear did not meet the “near time” emissions reduction strategies Aware needed to invest in to meet its energy transition targets.

These include a 45 per cent reduction in scope one and two emissions in its portfolio and net zero by 2050.

“We’re working towards that, and that doesn’t involve investing in nuclear,” Mr Graham.

“If there was a change [in policy] and there were new opportunities, we’d need to understand them … but the general view we have is we need to be making more near-time progress that I think nuclear appears to provide.

“It’s a long-term build, no doubt about it, and we need to be making really clear progress by 2030.”

He pointed to renewables and other transition-supporting technologies as attractive investment opportunities for the $170 billion super fund instead.

Mr Dutton pledged two nuclear power plants would be operational by 2035 under his plan and more potentially by 2037 if he was elected next year, despite the CSIRO estimating the first full operation of a station could be “no sooner” than 2040.

HESTA head of portfolio management Jeff Brunton declined to comment categorically on whether the healthcare workers’ fund would invest in nuclear, but noted some of its decarbonisation targets also had deadlines of 2030 rather than 2050.

It planned to invest 10 per cent of its funds under management into “green solutions” such as renewable energy and cut the carbon intensity of its overall portfolio by 50 per cent by 2050.

“So we need to deploy into those sorts of ideas – batteries, solar, wind farms – now,” Mr Brunton said.

He also noted HESTA would invest in line with the Australian Sustainable Finance Institute and Commonwealth Treasury’s sustainable investment taxonomy, which is currently being developed.

In a public consultation paper released in May, the groups proposed excluding nuclear power as a sustainable investment option under the taxonomy as its development is currently illegal in Australia.

Uncertainty abounds

Other CIOs said proposed policies to introduce nuclear power in Australia were too vague to justify considering investment.

Mr Dutton was criticised when he released his plan to introduce nuclear power to Australia for its lack of detail. He proposed seven sites for government-owned power plants, but did not provide any costing for the scheme and partly relied on technology that is not yet commercially viable.

“We don’t want to front-run [nuclear] saying we see an opportunity when there’s not the policy,” Mark Delaney, who runs AustralianSuper’s $335 billion investment portfolio, said.

He said nuclear was “a classic ESG issue” as it involved looking for long-term issues – in this case decarbonisation – that could positively or negatively affect returns, but there were still too many uncertainties.

“The policy will set the topography which any investment takes place in … [so] when they’ve worked out their policy, we will look for the opportunities.”

Colonial First State CIO Jonathan Armitage was on the hunt for undervalued infrastructure assets to bolster his fund’s unlisted exposure, but said nuclear was not part of that mix.

“Right now, there’s not enough information to make an informed decision,” he said. It would take “a lot more” to enable any serious consideration.

No comments yet.

Leave a comment