Staggering rise of clean energy in China a wake-up call to Australia – including on nuclear

Given the implications for Australian taxpayers of the massive capital, time and LCOE blowouts of A$50-60bn per nuclear plant, it’s time to call the nuclear debate here for what it is – a politically motivated furphy designed to derail the renewables transition.

Taxpayers have already funded six government nuclear inquiries since 2015 which all concluded nuclear is too slow and too costly.

Nuclear works at scale in China. Here, it is a deliberate distraction by fossil fuel incumbents and politicians on their payroll.

Tim Buckley, Apr 30, 2024, https://reneweconomy.com.au/staggering-rise-of-clean-energy-in-china-a-wake-up-call-to-australia-including-on-nuclear/

China is undergoing a monumental power shift, with the staggering rise of zero-emissions energy positioning the green powerhouse to end new coal power before 2030. This has massive implications for global and Australian decarbonisation.

Climate Energy Finance’s latest report, released this week, modelled China’s electricity system nationally at the annual level through to 2040, evaluating its likely GDP growth trajectory and the resulting energy demand growth, as well as the increased share and hence demand for electricity in the energy mix as China continues to pursue its ‘electrification of everything’ strategy of the last two decades.

CEF forecasts that through to 2040, China will install a world-leading 323GW per annum of solar capacity, 80GW of wind, 1GW of hydropower and 3GW of nuclear.

Sustaining this rate of installation of >400GW pa of zero-emissions additions a year – over six times the total capacity of Australia’s National Electricity Market (NEM) – would see China achieve its ‘dual carbon’ targets, to peak carbon emissions by 2030 and reach carbon neutrality by 2060, ahead of time.

This in turn opens up the potential for it to revise its emissions reduction pledge to net zero by 2050 or 2055, bringing the behemoth in line with the rest of the developed world.

While China’s total electricity demand will continue to rise through 2040 due to sustained strong economic growth and economy-wide electrification, CEF forecasts that the share of thermal power in total generation will progressively decline, from 70% in 2023 to just 50% by 2030 and potentially to just 30% by 2040. A staggering transformation in under two decades.

This astonishing acceleration of the nation’s energy pivot is reflected in its energy investment trend. China Invested US$890bn in cleantech in 2023, more than double the US as the second largest investor.

China installed 63GW of zero-emissions electricity capacity in the first three months of 2024, as much as the entire NEM of Australia. That represented growth of 35% year-on-year (yoy), building on the 301GW of new zero emissions capacity installed in 2023, which was in turn double the rate of new capacity installs of 2022.

This rate of expansion is both world leading and global energy system-transforming.

Nuclear in China

China also leads the world in deployment of new nuclear energy. The levelised cost of energy (LCOE) of nuclear, at US$70 per megawatt hour (MWh), is half the cost of the US$160/MWh in Europe and US$105/MWh in the US.

This is a key point that Australia’s nuclear proponents fail to appreciate: There are demonstrable financial benefits to the technology in a super-large-scale, centrally-planned economy with a well-entrenched record of deploying complex, dangerous, massively capital-intensive nuclear power plants every year. These conditions do not apply in western economies and are completely out of the question for Australia.

The IEA estimates China can build nuclear power plants at half the capital cost of the US and Europe, and in almost half the time. Australia, on the other hand, has never built a commercial nuclear power plant, as confirmed by the World Nuclear Association.

China currently has 54GW of operable nuclear power reactors, with 31GW of nuclear power reactors under construction, another 45GW in planning and 98GW proposed as of February 2024, with more proposals for new nuclear reactors awaiting approval.

CEF’s Chinese electricity model forecasts China will double its nuclear power plant fleet to 108GW by 2040 to be #1 in the world in terms of total installed capacity, overtaking the US at 100GW.

December 2023 saw the world’s first 4th generation nuclear power plant go into commercial operation, operated by Huaneng Shandong Shidao Bay Nuclear Power. The facility has a modest net capacity of 150MW, but still took a lengthy 11 years to construct after approval in 2012.

In 2011 the National Energy Administration (NEA) announced that China would make nuclear energy the foundation of its electricity generation system in the next “10 to 20 years,” adding as much as 300GW of nuclear capacity over that period.

China has delivered less than a sixth of this target. Post Fukushima China wanted to only install the most modern facilities deploying the latest technology, which they developed themselves, becoming the world leader in this technology as in all zero-emissions technologies of industries of the future..

We forecast China will add 3GW annually of new capacity as part of its all-of-the-above strategy for domestic power generation. We estimate nuclear will rise to 790TWh of annual generation by 2040, representing a national share of 5.0% (vs 433TWh and a 4.9% share in 2023), just a fraction of the 20-25% share targeted a decade ago.

With the massive scaling up of nuclear power capacity in China, the IEA models the real LCOE will fall 10% to US$65/MWh by 2050, vs the 50% decline in solar LCOE to US$25/MWh.

By comparison, the IEA models Chinese coal with carbon capture and storage will rise to US$220/MWh, ten times the cost of solar, and three times the 2050 cost of nuclear, making coal increasingly uneconomic.

In short, nuclear makes sense as part of the zero-emissions energy mix in China given the need to decarbonise at speed.

As for its viability in Australia, there is not a single small scale nuclear reactor (SMR) – the Federal Coalition’s preferred nuclear technology – approved for construction anywhere in the world outside of Russia and China.

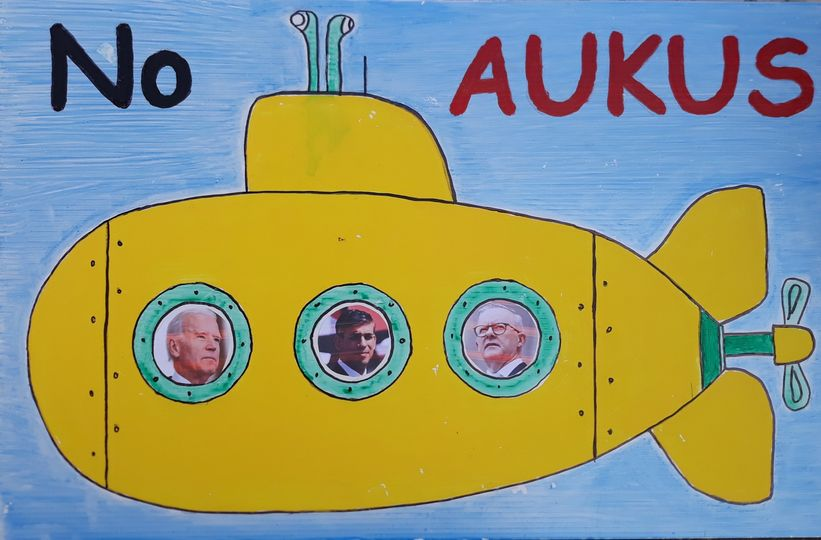

This begs the question of whether Opposition Leader and chief nuclear spruiker Peter Dutton is proposing to deploy 4th generation Chinese developed technologies, or antiquated 2nd generation Russian technology, here.

Given the implications for Australian taxpayers of the massive capital, time and LCOE blowouts of A$50-60bn per nuclear plant, it’s time to call the nuclear debate here for what it is – a politically motivated furphy designed to derail the renewables transition.

Taxpayers have already funded six government nuclear inquiries since 2015 which all concluded nuclear is too slow and too costly.

Nuclear works at scale in China. Here, it is a deliberate distraction by fossil fuel incumbents and politicians on their payroll.

Let’s wait till at least one plant is commissioned and the cost of nuclear power plants built somewhere in the west is remotely affordable and proven, and timeframes for deployment make sense as the imperative to decarbonise escalates, and then have a debate about its merits.

Opportunities for Australia

The critical shift in the energy landscape in China that we map toward zero-emissions technology, with coal playing a diminishing back-up role, also has profound significance for Australia – including the inevitable decline in demand for coal in China.

This is a wakeup call for Australia to accelerate the transition of its economy from its historic overdependence on coal exports and diversify its economic base. We should be pivoting now to deploy our natural advantages – our world-leading wealth of critical minerals and strategic metals – to produce value-added energy transition materials for export.

Key to this is enhancing cleantech supply chain partnerships and bi- and multilateral agreements in the Asian region – a central premise of the new Future Made in Australia Act – including with China, the world’s green economic powerhouse.

And while they do nuclear, alongside their accelerating VRE capacity additions, we can be “embodying decarbonisation” in our exports by value-adding our lithium and other critical minerals, producing green iron, and manufacturing energy transition materials such as cleantech using the boundless potential of our superabundant renewable energy.

For this, we also need to be boosting the ambition, speed and scale of our utility and distributed wind and solar rollout, a critical enabler of Australia’s opportunity to reposition the domestic economy as a zero-emissions trade and investment leader in a rapidly transitioning world.

Nuclear has no viable part in this picture.

No comments yet.

Leave a comment