What Australia can learn from China to become the world’s ‘cleaner’ rare earth refiner.

“People don’t quite grasp how much waste we’re talking about.”……………………… cases of cancers, arsenic poisoning and birth and joint deformities linked to years of unregulated dumping.

By Libby Hogan and Xiaoning Mo, Sat 15 Nov, https://www.abc.net.au/news/2025-11-15/australia-refining-rare-earths-environmental-challenges/105969994?utm_source=abc_news_app&utm_medium=content_shared&utm_campaign=abc_news_app&utm_content=other

Australia holds a plethora of rare earths — minerals essential for all sorts of cutting-edge technologies from wind turbines to hypersonic missiles.

Until now, most of them have been sent to be refined in China.

That is largely because the process is dirty, expensive, and politically unpopular.

But after last month signing a $13 billion critical minerals deal with the United States to boost production and refining, Australia must deal with some significant environmental challenges — mostly around water.

Marjorie Valix, a professor of chemical engineering at the University of Sydney, who researches sustainable mineral processing, said Australia has plenty of opportunity — and responsibility — in this space.

“Rare earths aren’t rare in Australia — especially light rare earths,” said Professor Valix.

“But water is one of the vulnerabilities.”

The bottleneck

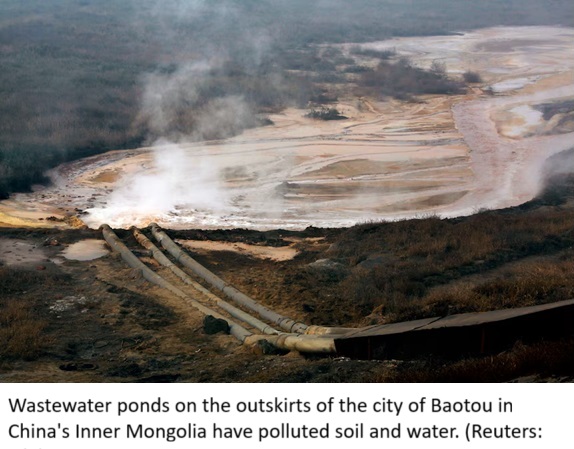

When researcher Jane Klinger first visited China’s Bayan Obo mine at Baotou in Inner Mongolia — the world’s largest rare-earth operation — more than a decade ago, she expected to see the future of green technology.

What she found instead was a cautionary tale: acidic wastewater and radioactive residue in unlined ponds along with contaminated rivers and farmland.

“The stuff we want is typically a very small percentage of what’s dug up,” Professor Klinger, author of Rare Earth Frontiers, told the ABC.

“And then there’s the waste that’s generated to separate the valuable bits from the rest of the rock.

“People don’t quite grasp how much waste we’re talking about.”

For every tonne of rare-earth oxide produced, roughly 2,000 tonnes of acidic wastewater are left behind.

It was a local taxi driver, pointing to a new hospital built to treat bone disorders, who tipped her off to what was unfolding around Baotou.

She discovered cases of cancers, arsenic poisoning and birth and joint deformities linked to years of unregulated dumping.

Australian National University professor of economic geology John Mavrogenes said the Chinese companies were mining by drilling and pouring chemicals into the holes.

“They found it was so bad environmentally that even China decided maybe they should quit,” he said.

The health and environmental impacts were so severe Beijing has since tightened regulations and cleaned up some sites.

It has also shifted much of its most-polluting refining methods to neighbouring Myanmar.

In Jiangxi province, China’s other main rare earth mining hub in the south, more than 100 mine sites have been shut down in the past decade and converted into parks, according to local media.

Learning from China’s mistakes

Experts insist Australia can do better.

The Donald Rare Earth and Mineral Sands mine in western Victoria — which was given major projects status last month — will use a method that uses fewer chemicals than hard-rock mining to extract rare earths.

Once operational, the site is expected to become the fourth-largest rare earth mine in the world outside China.

The company behind the project, Astron, plans to rehabilitate the land and send its rare-earth concentrate to Utah for further processing, where uranium will also be recovered.

Victoria bans uranium mining outright, but the US intends to use the by-product as fuel for nuclear power plants.

Professor Klinger said one of the most impactful lessons from what she found in China was simple.

“Don’t dump this stuff in tailings ponds without liners,” she said.

“Don’t contaminate groundwater, but also pay attention to ‘who’ is doing the modelling and monitoring.”

When the Donald mine starts production next year, processing is to take place in enclosed sheds, with waste sealed into containers and shipped off-site.

But Australia has not always had a spotless record: past projects such as fracking in the Northern Territory and old coal mines show how environmental oversight can fail.

The water dilemma

China dominates the separation and refining of rare earths, controlling over 90 per cent of global production.

In Western Australia, Iluka Resources is building Australia’s first rare earths refinery.

The process — crushing rock, separating minerals, and neutralising the waste — requires vast amounts of water.

Iluka’s refinery will consume just under 1 gigalitre of groundwater per year.

Iluka head of rare earths Dan McGrath told the ABC the refinery would operate as a zero liquid discharge facility.

“Our design avoids generating liquid waste altogether, and the reagents we use create a saleable fertiliser by-product instead of requiring disposal.

“All remaining solids will be disposed of in existing mine voids, removing the need for new waste containment facilities or above-ground disposal facilities.”

Professor Mavrogenes said water scarcity was already shaping where new mining projects could go ahead.

“Water is an issue because most ores are located in areas that don’t have enough water,” he said.

The Iluka refinery will produce both light and heavy rare earth oxides used in advanced manufacturing of items, including medical devices and defence weaponry.

A wastewater treatment plant will form part of the facilities, but the plan has drawn criticism amid ongoing water shortages.

In Victoria, Astron has secured water entitlement from Grampians Wimmera Mallee Water.

Geologists including Professor Mavrogenes have warned that a secure water supply and planning needed to account for climate change.

“Flooding can shut down processing, especially with heap leaching,” he pointed out.

Heap leaching is where a chemical solution is trickled through a heap of crushed ore, often in a pond, to dissolve the metals.

Other environmental concerns once shadowed Lynas Rare Earths, Australia’s largest producer of rare earths, which ships semi-processed concentrate to Malaysia for refining.

The company initially faced local protests over low-level radioactive waste.

Kuan Seng How, assistant professor in Universiti Tunku Abdul Rahman’s Department of Mechanical and Materials Engineering, said Lynas had since built a permanent, sealed facility to prevent groundwater seepage — an expensive but necessary fix.

Together, Iluka’s new refinery and Lynas’ remediation effort illustrate the same lesson: refining is not just an engineering problem but a resource-management one.

A cleaner frontier

China now lines its wastewater ponds with bentonite clay to reduce leakage and collects some run-off for reuse.

Yet even those measures have not stopped some seepage leaking outward, according to a recent article published in the Chinese journal Modern Mining.

Industry and researchers are now exploring waterless extraction technologies such as solvolysis — a process that uses chemical solvents instead of water to extract rare earths.

“It can leach and separate the metals in one step,” Professor Valix said.

“But it hasn’t been scaled up yet — and right now it’s more expensive.”

She sees water management as the defining test of Australia’s ambitions.

Her colleague Susan Park from the University of Sydney added that as countries raced to upgrade rare earth processing, Australia must invest more in knowledge.

“One of the issues is the absence of long-term research and development into these technological processes and training people,” she said.

China may already be a step ahead, testing new techniques on a large scale.

In January, the Chinese Academy of Sciences claimed a breakthrough: an electrokinetic extraction technique that slashes the use of leaching agents by 80 per cent, mining time by 70 per cent and energy consumption by 60 per cent.

According to the scientists who revealed the development in the journal Nature Sustainability, the method could soon be viable for large-scale production.

For Australia, Professor Valix said the barrier was not capability but commitment.

“It’s not that we don’t have the technology,” she said.

“What we don’t have is the investment and the uptake market here like battery makers or manufacturers.”

Rare Earths processing – a backdoor way into radioactive waste dumping in Australia?

28 October 2025, Noel Wauchope, https://theaimn.net/rare-earths-processing-a-backdoor-way-into-radioactive-waste-dumping-in-australia/

Joy and delight! Australia is to have a booming rare earths industry, mining and PROCESSING – jobs jobs jobs! Money money money!. And we can stick it up to China, confronting its near monopoly on the industry!

The reality is something very different.

Apart from the enormous and time-consuming problems involved in establishing this industry, and in competing economically with China, there’s that other unmentionable problem – RADIOACTIVE WASTES.

Western Australia’s Lynas Rare Earths company knows all about this. They’ve had no end of trouble with their rare earths processing and its radioactive wastes. They were smart enough, had the foresight, to set up processing in another country. Lynas moved its rare earths processing to Malaysia because of Malaysia’s less stringent laws. But what they didn’t reckon with, was Malaysia’ ‘s history, and awareness of radioactive waste danger. As Lynas’ plant started operations in 2012 – in Kuala Lumpur: 10,000 marched for 13 days, rally against Lynas rare earths processing plant. Former Malaysian Prime Minister Mahathir Mohamad imposed stringent conditions on Lynas’ operations.

Malaysians remember the environmental and health disaster of Bukit Merah; where, early this century, rare earth processing left a toxic wasteland.

A longer explanation is provided in this documentary –

It is very hard to get information on Lynas’ processing operations in Malaysia. I remember that a few years ago, there was a controversy, and an Australian protest movement against Lynas’ plan to dump these wastes into an old growth forest in Malaysia. I can now find no record of this. And indeed, many news items of the controversies of Lynas’ Malaysia operations have now vanished from the internet.

But this Malaysian issue has not gone away – Pollution issues and controversy over rare earth company Lynas.

If Malaysia’s history of radioactive pollution from processing of rare earths is scandalous, – what about China’s history?

I know that in recent years, China has cleaned up its act on industrial pollution. But its history is shocking – with a legacy of “cancer villages” –

Whole villages between the city of Baotou and the Yellow River in Inner Mongolia have been evacuated and resettled to apartment towers elsewhere after reports of high cancer rates and other health problems associated with the numerous rare earth refineries there. – China’s legacy of radioactive pollution from rare earths processing.

Well, is everybody now pretending that that to introduce rare earths processing in Australia is a good thing, no problem, it’s progress – blah blah?

This new development comes just as Australia’s government introduces its new reforms to the Environment Protection and Biodiversity Conservation Act – including the aim to simplify and speed up approvals for development. We wait to see what that entails – could it be the weakening of environmental standards?

Coincidentally, Mr Trump’s USA is changing the standards on radiation safety. An Executive Order from the White House states:

“In particular, the NRC shall reconsider reliance on the linear no-threshold (LNT) model for radiation exposure and the “as low as reasonably achievable” standard, which is predicated on LNT. Those models are flawed”, – ORDERING THE REFORM OF THE NUCLEAR REGULATORY COMMISSION.

This will likely result in a significant weakening of the current standards at a time when the evidence strongly suggests that they are in need of further tightening.

The environmental movement fights on – but with a wave of enthusiasm for renewable energy development. A recent article discussed recycling of rare earths from our many digital devices. That’s an idea that seems to be ahead of its time, especially given the extreme difficulty of retrieving those elements from mobile phones, laptops etc.fficulty of retrieving those elements from mobile phones, laptops etc.

Well, it’s the (?) futuristic idea of the circular economy. It fits in with those unfashionable concepts of energy efficiency, energy conservation. We used to hear about them, in the early days of action on climate change.

These concepts are anathema to our billionaire leaders, as we are all drawn into the mindless rollercoaster of ever more artificial intelligence, with its ever more energy use.

Australia, federally and in each State has strong restrictions on radioactive processes. The nuclear lobby has tried for decades to weaken or overthrow those restrictions, and to introduce radioactive waste dumping in a big way.

We’ll be pitched the story that the radioactive wastes from rare earths processing are “minor” “low key” – acceptable. Let’s not worry – after all, the whole rare earths thing is so complex, and so far into the future.

But Albanese so readily agreed with Trump, that Australia can have both the mining and the processing of rare earths – it opens the door up to radioactive waste dumping,

Meanwhile, the issue is also relevant to Australia’s agricultural industry, particularly in Victoria. Victoria being blessed with rich agricultural land, regions like the Wimmera and Gippsland could be threatened by these new industries. The nuclear lobby, too, has long salivated on the possibility of a thorium industry there, too

It’s a sad thing – that history is forgotten, in these days of super-fast “progress’ into the Age of AI. We are being led by the nose by those technobillionaires surrounding Donald Trump – to believe that we don’t need to do much working, or thinking – as we race into this golden age, and embrace this new radioactively-polluting industry.

Why Australia’s Rare Earth Deal Serves U.S. Interests

24 October 2025 AIMN Editorial , By Denis Hay

Australia’s rare earth deal with the US fuels its military industry, not our sovereignty. Here’s why that matters.

Introduction: Australia’s Strategic Crossroads

In October 2025, Prime Minister Anthony Albanese signed an $8.5 billion rare earth deal with the United States, promising closer economic and security ties. The agreement appears to be an opportunity to boost Australia’s resource sector. Yet beneath the surface, it reveals a deepening alignment with the US military-industrial complex through the AUKUS alliance.

As China restricts exports of key rare earth metals used in advanced weaponry, the US is turning to Australia for supply. The question is simple but profound: is the rare earth deal Australia signed a path to sovereignty, or servitude?

The Problem: How the Deal Strengthens Dependence

1. The Geopolitical Trigger – China’s Ban and US Pressure

China’s export controls on critical minerals such as gallium and germanium were a strategic response to the US using them for missile guidance systems, fighter jets, and submarines. Washington needed a reliable alternative, and Canberra complied.

Through the AUKUS alliance, Australia is being drawn into the US defence supply chain, undermining our ability to chart an independent foreign policy. Rather than investing in peaceful manufacturing and clean-energy industries, our resources are now fuelling a global arms race. (ABC News)

2. Resource Exploitation Without Return

Australia holds about 20% of the world’s rare earth reserves, yet most of our minerals are exported raw and processed overseas. This deal continues that pattern, foreign corporations’ profit while Australians bear the environmental costs. Public money is used to subsidise foreign ventures instead of funding domestic processing plants that create local jobs. (AP News)

The Impact: What Australians Are Experiencing

3. From Mining Boom to Dependency Economy

Despite decades of booms, Australia is still a “dig-and-ship” nation. The rare earth deal Australia signed solidifies our position as a key supplier of raw materials to the US military supply chain. Communities see little benefit while regional inequality and labour insecurity grow.

4. Who Really Benefits

The true winners are US defence contractors like Raytheon and Lockheed Martin, who depend on steady rare earth supplies for weapons production. Under AUKUS, Australia is obliged to supply these resources for military use while receiving limited technology transfer. Once again, public money serves private foreign interests. (Politico)

Who Owns the Processors: and Who Gets the Profits

The Albanese government’s rare earth deal, which Australia signed with the United States, has been presented as a boost to local industry. Yet a closer look at who owns the companies processing these critical minerals shows the profits often flow overseas or to private shareholders, not the Australian public.

1. Iluka Resources – Eneabba, Western Australia

Iluka runs Australia’s first integrated rare-earth refinery, funded by a $1.65 billion public loan from the federal government’s Critical Minerals Facility. The project includes a “no-China” clause to satisfy US and UK defence interests. Although Iluka is ASX-listed, profits go to private and institutional investors, not the public, while its supply contracts serve foreign markets.

2. Lynas Rare Earths – Kalgoorlie and Malaysia

Lynas, another ASX-listed firm, runs processing plants in Kalgoorlie and Malaysia. It received early investment from Japan’s Sojitz and JOGMEC, who keep offtake rights. A substantial part of Lynas’s refined output is exported to Japan and US defence manufacturers, making Australia a supplier in the AUKUS alliance rather than an independent producer.

3. Arafura Rare Earths – Nolans Project, Northern Territory

Arafura promotes itself as an Australian company, but binding offtake agreements with Hyundai, Kia, Siemens Gamesa, and Traxys cover most of its planned production. This means much of its revenue will come from foreign contracts, while Australian taxpayers help fund infrastructure and environmental oversight.

4. Alpha HPA – Gladstone, Queensland

Alpha HPA’s high-purity alumina project has been hailed as a clean-tech success, supported by hundreds of millions in government loans. However, its customers are primarily offshore electronics and battery manufacturers, meaning the profits leave Australia even though public funds help build the facilities.

5. Australian Strategic Materials (ASM) – Dubbo, New South Wales

ASM’s Dubbo project has strong ties with a South Korean consortium, with potential equity and offtake arrangements already in place. While the plant is in Australia, most of the downstream manufacturing and profit realisation will occur in Asia.

The Sovereignty Gap

While several companies are headquartered in Australia and listed on the ASX, the real issue is who controls the value chain. With foreign investors and defence-aligned buyers dominating the market, Australia captures little of the long-term benefit.

Despite processing more at home, the profits and strategic control remain offshore, perpetuating the dependency model that the AUKUS alliance reinforces…………………………………………………………………………………………………………………………………. https://theaimn.net/why-australias-rare-earth-deal-serves-u-s-interests/#comment-14832

Could Australia’s trash become Donald Trump’s treasure? Turning our waste into critical minerals

21 October 2025 AIMN Editorial, UNSW Sydney

UNSW Sydney Media Release

Key facts:

- Australians generate around 20kg of e-waste per person every year

- Some of the components inside this everyday waste include critical minerals, which can be reused and recycled

- At the National Press Club in Canberra today, Professor Veena Sahajwalla called on policymakers, industry and communities to embrace our waste.

As Donald Trump and Anthony Albanese announce a new, multi-billion-dollar critical minerals pact, UNSW Professor Veena Sahajwalla will tell the National Press Club in Canberra how onshore recycling technologies can recover these critical minerals from our waste stream – making the adoption of this cutting-edge technology a strategic, economic and environmental imperative.

At the National Press Club in Canberra today, UNSW Sydney’s Scientia Professor Veena Sahajwalla called on policymakers, industry and communities to embrace a new vision for Australia’s waste. Instead of relegating waste to landfills, incinerators or stockpiles, she argued it can drive innovation, support local industries, create jobs and deliver environmental and social benefits.

“True sustainability demands we harness this potential and transform waste into a resource stream for advanced manufacturing,” Prof. Sahajwalla said.

Australians generate around 20kg of e-waste per person every year, but many of the valuable minerals inside are never recovered. Some of the components inside this everyday waste include critical minerals, which can be reused and recycled, meaning there is both a strategic as well as an economic and environmental need to adopt this technology.

Using techniques Prof. Sahajwalla has designed, those waste resources can be reused and turned into new and valuable products.

E-waste is one aspect of a waste management crisis Prof. Sahajwalla’s work seeks to remedy.

In communities across Australia, her team’s pioneering MICROfactorieTM technologies are already showing what this future looks like. In Sydney’s south-west, discarded mattresses are being turned into green ceramic tiles, supporting local manufacturing jobs and helping councils reduce waste management costs. In Taree in regional NSW, reclaimed aluminium is being reformed into new aerosol cans. While in Sydney’s north, e-waste is being remanufactured into 3D printing filament.

“Using our waste resources as feedstock develops a circular economy where supply chains are linked up and local jobs are created, with significant environmental and social benefits,” she said.

Prof. Sahajwalla is Director of UNSW’s Sustainable Materials Research and Technology (SMaRT) Centre, which is internationally recognised for pioneering the concept of ‘MICROfactories’. The SMaRT Centre is home to MICROfactories technology, turning small, modular recycling systems that transform discarded products such as mattresses, glass, textiles, and electronic waste into valuable materials and products.

Her team’s work with councils and industry partners shows how this transformation is already taking shape:

Creating tiles from waste

In her address, Prof. Sahajwalla shared details of how the Liverpool City Council in Sydney’s south-west has turned a major waste problem into a circular economy success story. When the Council realised it was spending hundreds of thousands of dollars annually to dispose discarded mattresses it partnered with Prof. Sahajwalla’s SMaRT Centre to pilot a MICROfactorieTM to shred and re-manufacture the materials………………………………………………………………………………………………

She also outlined a vision in which MICROfactories could be established in cities, towns and regional communities across the country, each tailored to local waste streams and employment needs. In regional NSW, her team is working with the Aboriginal community in Wellington near Dubbo to use green ceramic tiles in sustainable housing projects, supported by the federal government’s Sustainable Communities and Waste Hub (SCaW).

Turning university research into real-world impact

Prof. Sahajwalla said Australia must do more to ensure university research translates into real-world impact. She called for governments to lead by example in adopting Australian-made sustainable technologies, and to reward companies that invest in local R&D.

“By and large, our professional incentives are not geared towards the long-hours it takes to actually build the machine that can make a world-saving idea a reality,” Prof. Sahajwalla said…………………………………………………………… https://theaimn.net/could-australias-trash-become-donald-trumps-treasure-turning-our-waste-into-critical-minerals/

The Australian investors betting big on fusion – the “holy grail” of nuclear tech

ReNewEconomy, Rachel Williamson, Apr 17, 2025

One of Australia’s biggest super funds is backing nuclear tech – but not the kind being pitched by the federal Coalition.

Hostplus is investing in fusion energy.

CIO Sam Sicilia says a combination of tech advances in the last five years and a youthful member base means fusion is now a real option for big, patient investors…………………

Fusion power is the holy grail of energy technologies: it makes more energy than nuclear fission, produces less waste, doesn’t create anything that could be used in a weapon, and has zero risk of meltdown.

The truth is more complicated, not least because the longest ever sustained reaction was only achieved in January, when China’s “artificial sun” reactor in Heifei managed a whole 17 minutes. …………………..

And with almost half a billion dollars of funding sunk into the industry last year, the race is on for companies ranging from Commonwealth Fusion Systems – the MIT spinout that is leading so far and Hostplus’ investment pick – to Australian startup HB11………………………………………………………………………………

If this sounds ambitious for a technology that just five years ago was still wrestling with major functional problems, it isn’t to people in the industry – even in Australia.

Patrick Burr leads the student project to build a donut-shaped tokamak fusion reactor – just a little one – at University of New South Wales (UNSW). He also works with Australia’s only home-grown fusion company, HB11 Energy.

He says commercialisation of fusion energy is now an engineering problem that requires money and people…………………………………………………………………………..

Australia as a fusion power? Maybe

Matt Bungey is taking a bet that fusion energy will be ready for launch – in Australia – by the late 2030s.

Bungey is a partner at Western Australian venture fund Foxglove Capital and an investor in another fusion frontrunner, Type One, which recently set up an Australian subsidiary.

He believes fusion should be part of a diverse energy strategy even if by the late-2030s renewables and storage are the dominant generators.

But he does admit there is a deadline.

“There’s a timing element here, if you don’t get it right before the mid 2040s there’s a question of whether you really need it,” he says.

The other view is that Australia’s energy needs will scale in unimaginable ways as the demands of decarbonisation and AI require more electricity……………………………………………………………..

Today the global industry has attracted $US7 billion ($A11 billion) in funding, according to the FIA.

But even the $A130 billion Hostplus is merely dipping a toe in – its CFS investment is worth $US136 million.

Still, CFS CEO Bob Mumgaard says there is enough curiosity in the technology from within Australia to warrant a look here – even if nuclear power generally is still illegal. ……………………………………………………………………………………

Australia enters the chat, with HB11

Australia does have its own fusion startup in HB11. It is forging a technology path quite different to those pursued by CFS (a tokamak design) or Type One (a stellarator).

HB11 is using lasers and a proton-boron fuel, rather than the more common deuterium/tritium, deuterium/deuterium, or deuterium/helium3 combos.

“The key difference between what we’re doing and what most of the other private fusion companies are doing is we’re using [boron] which does not produce neutrons,” McKenzie says.

Boron is abundant and costs about a dollar a kilogram, and the method of firing a laser at small pellets to create an ongoing reaction doesn’t make the materials around them radioactive – more on this later.

McKenzie gently negs the tokamak and stellarator players, saying none have produced a net gain – more energy out than in – whereas laser fusion has, in December 2022 at the National Ignition Facility in California.

“The catch is it’s much harder to produce. Essentially we’ll need much bigger lasers [than we have now],” McKenzie says.

How big, you might ask?

Computer simulations suggest that, right now, they may need to be several football fields long and multiple storeys high. The National Ignition Factory’s laser is in a 10-story building about the size of three American football fields; China’s version in the southwest city Mianyang will be 50 per cent larger again, a size MxKenzie says “is about right”.

HB11 has a plan for its version of fusion to be widespread by the mid-2050s but it has a long way to go.

“When we achieve a neutronic hydrogen-boron fusion energy gain we’ll be on our way to Stockholm to pick up a Nobel prize,” McKenzie says.

Is it illegal or not?

Australia’s ban on nuclear fission technology for energy might apply to fusion – but also might not.

Experts spoken to by Renew Economy say there isn’t much interest within federal government to revisit nuclear rules and carve out a new area for fusion, somewhere between legal nuclear medicine and illegal fission.

But the UK and USare showing how fusion might be introduced, without dumping it in with fission.

Both countries say they won’t regulate fusion technology like fission, but instead treat the new reactors more like a particle accelerator.

That’s a framework that advocates like Bungey are pinning their hopes on, given almost every major hospital in Australia houses a particle accelerator to make nuclear medicines. These are controlled by the Australian Radiation Protection and Nuclear Safety Agency (ARPANSA) as well as a suite of other regulators.

McKenzie says the deuterium-tritium fuel might be difficult for nations to support, given both are fuels used in nuclear weapons, but generally fusion should not be affected by national bans on fission energy.

“My legal understanding is that it will not come under Australia’s nuclear ban. But yes … what the rest of the world is doing, fusion is a relatively new field with no regulations,” he says.

“The US and the UK very recently passed legislation where the nuclear fission and fusion regulators are different and they require different standards, so you’re starting to separate the two technologies and that makes a big difference.”

But it’s Italy that might be the most appropriate model for Australia because it’s coming from a total ban on nuclear energy as well, Mumgaard says.

But Italy is also un-banning fission technology after a 40-year hiatus, producing a draft law in March to set up both fission and fusion technologies.

Pros and cons

Fusion is now such a small sector in Australia that it’s hard to find one person who isn’t connected to one of the local or global companies competing to be first, cheapest, or most realistic.

UNSW’s Patrick Burr is involved with HB11 but happy to also cut through the marketing speak. Every technology, as Burr says, has its drawbacks.

The main problem today is talent. Burr says companies are already cannibalising each other’s staff, from fusion engineers, scientists, down to people in the supply chain, and educating new talent was one reason why UNSW launched the student-led tokamak project.

But there are some practical problems as well which are high on the ‘to solve’ list of the engineers.

One of the first dot points on any ‘why fusion is better’ powerpoint slide is the tiny amount of waste it produces from a reaction.

But this is misleading. The irradiated waste of a fusion plant is the whole internal structure, albeit with a hundreds of years half life instead of a thousands of years half life.

Dealing with concrete or equipment that is toxic for hundreds of years is manageable for a society, Burr says. The challenge will be figuring out how to handle the higher volumes of radioactive material.

Another drawback is the source of fuel.

The most common fuel pairing is deuterium and tritium – the former is abundant in nature, the latter is not and has a short half life. Other fuels have their own challenges, such as HB11’s boron-hydrogen method, which right now requires giant lasers to activate.

Taking a position on nuclear energy in a country like Australia, where it doesn’t exist outside the medical sector, is a bet on the distant future.

For Burr, it’s a question on whether Australia will have won the fight with hard-to-decarbonise sectors in 50 or 100 years’ time. And whether the country wants to make a bet today on a technology that may – or may not – be that solution. https://reneweconomy.com.au/the-australian-investors-betting-big-on-fusion-the-holy-grail-of-nuclear-tech/

If China can’t scale nuclear, Australia’s got Buckley’s

Dutton’s proposal has seven nuclear power plants, including five large-scale reactors and two SMRs. This isn’t critical mass for a nuclear program. As of February 2025, the United States operates 94 nuclear reactors, France has 57, and South Korea maintains 26 reactors. Those are sufficient numbers of GW-scale reactors to achieve program economies of scale. Australia’s peak electricity demand of 38.6 GW isn’t sufficient to provide an opportunity for sufficient numbers of reactors of a single design to be built.

Michael Barnard, Feb 25, 2025, https://reneweconomy.com.au/if-china-cant-scale-nuclear-australias-got-buckleys/

The platypus of energy in Australia has reared its duckbill and stamped its webbed feet again in recent years.

A fractious group of bedfellows is advocating for nuclear generation, primarily driven by the Liberal-National Coalition under Peter Dutton, who has proposed repurposing decommissioned coal-fired stations for nuclear power, with the remarkable claim that reactors could be operational between 2035 and 2037.

Other political supporters include the Libertarian Party and One Nation. Unsurprising advocacy organisations such as the Australian Nuclear Association, Nuclear for Australia, the Minerals Council of Australia, and the South Australian Chamber of Mines and Energy are calling for legislative changes to allow nuclear development, citing its reliability and low emissions.

Notable figures like opposition energy spokesperson Ted O’Brien, who has chaired parliamentary inquiries into nuclear energy, and Indigenous leader Warren Mundine, who sees nuclear as an economic and climate solution, have also voiced strong support.

But nuclear energy, like the platypus, is an oddly shaped beast, and needs a very specific hole to fit into the energy jigsaw puzzle.

Successful nuclear programs share several key conditions, drawn from historical examples in the United States, France, South Korea, and the UK. These countries achieved large-scale nuclear deployment first by making it a top-priority national goal, tied to military strategy or energy security.

Bipartisan support ensured long-term stability, while military involvement helped enforce cost discipline and continuity over decades. Australia clearly doesn’t have bipartisan support for nuclear energy.

Previous countries found political consensus in the face of serious geopolitical threats from nuclear armed enemies such as the Soviet Union and North Korea. Australia isn’t threatened by invasion or nuclear war by any country, and the major political parties are clearly on opposite sides of the fence on the subject.

Teal MPs, supported by Climate 200 and a major new force, are in general not supportive of nuclear energy either.

Australia’s federal laws prohibit nuclear power development through the Environmental Protection and Biodiversity Conservation Act 1999 (EPBC Act), which explicitly bans the approval of nuclear power plants.

The Australian Radiation Protection and Nuclear Safety Act 1998 (ARPANS Act) restricts certain nuclear activities, reinforcing the ban. Both laws would have to be repealed or substantially altered, requiring draft legislation to start with. No draft legislation has been in evidence from the Liberal-National Coalition, which appears par for the course for a campaign plank which is very light on details.

If the Liberal-National Coalition were to regain power, they would first have to draft a bill, and then shepherd it through the extensive legislative process, something that with contentious bills can take up to two years. That’s just the beginning.

Australia’s status as a signatory to international nuclear non-proliferation treaties adds a layer of complexity to any move toward nuclear power. Compliance with agreements such as the Treaty on the Non-Proliferation of Nuclear Weapons (NPT) and safeguards enforced by the International Atomic Energy Agency (IAEA) would require strict oversight of uranium handling, enrichment, and waste disposal.

Any shift to nuclear energy could trigger lengthy negotiations with global regulatory bodies to ensure Australia remains within its non-proliferation commitments, delaying and complicating the development of a civilian nuclear program.

The duration for individual countries to negotiate and implement these protocols has ranged from a few months to several years, influenced by national legislative processes and political considerations.

Strong central control is another common factor in successful nuclear programs. National governments directly managed nuclear projects, maintaining tight oversight of construction schedules and decision-making. This approach prevented fragmentation and ensured that experienced leadership remained in place throughout the deployment.

In Australia, power systems are largely under state control, meaning any attempt to build nuclear power plants would require approval from individual state governments. While the federal government sets national energy policies and regulates nuclear safety, states have the authority over planning and construction approvals.

Several states, including Victoria, New South Wales, Queensland, and South Australia, have explicit bans on nuclear power, adding another layer of legislative hurdles. Even if the federal ban were lifted, nuclear development would still depend on state cooperation, making a nationwide rollout politically and legally complex.

Building a skilled workforce was essential to scaling nuclear generation. Successful programs invested in national education and certification systems, training engineers, construction workers, and technicians specifically for nuclear projects. Strict security measures were also necessary to vet personnel and prevent risks.

That’s challenging for Australia. The Australian National Training Authority (ANTA) was abolished on July 1, 2005, with all its functions transferred to the Department of Education, Science and Training. This move aimed to centralize vocational education and training (VET) oversight at the federal level, streamlining operations and reducing administrative complexities associated with the previous federal-state arrangements.

Despite this degree of centralisation, the administration and delivery of VET programs remain primarily under state and territory control, with public technical and further education institutes and private providers delivering courses under regional oversight.

While the coordination and policy aspects of ANTA’s functions persist at the national level, the execution and management of training programs continue to be managed by individual states and territories.

That’s not a good basis for a nationally run and managed nuclear workforce education, certification and security clearance program that would need to persist for thirty to forty years. A nuclear ANTA would have to be established, taking time in and of itself, and then it would take time to attract and create a critical mass of skilled nuclear engineering, construction, operation and security human resources.

Speaking of security, Australia’s nuclear ambitions come with an often overlooked cost: an immense, multilayered security burden that taxpayers will likely shoulder.

In the US, nuclear power requires an extensive web of international, national, state, and local security measures, yet much of this expense is not covered by reactor operators.

The US government funds $1.1 billion annually in international nuclear security, including protecting supply chains and waste management through agencies like the IAEA, the Department of Defense, and the CIA. These costs translate to $8 million per reactor per year, with a full lifecycle cost of $1.2 billion per reactor—expenses that remain largely hidden from public scrutiny.

Domestically, the security footprint is even larger. The U.S. Nuclear Regulatory Commission, the Department of Energy, Homeland Security, and law enforcement agencies provide a $26 million per reactor per year security umbrella, ensuring compliance, protecting fuel transport, and defending against threats.

On-site security measures – including armed patrols, cyber protection, and emergency response teams – add another $18 million annually per reactor. In total, US taxpayers effectively subsidise $34 million per reactor per year, or $4 billion over a nuclear site’s lifespan, a cost that is rarely included in nuclear energy debates.

For Australia, these figures should serve as a stark warning. If nuclear reactors are built, the country will need to establish entirely new layers of security infrastructure, from federal oversight and emergency response teams to military-style site defenses.

The financial burden won’t fall on private operators alone – it will land squarely on the Australian taxpayer. As policymakers debate nuclear’s role in the country’s energy future, they must ask: are Australians ready to take on a security commitment of this scale?

A single, GW-scale, standardised reactor design was crucial to keeping costs under control. Countries that succeeded in nuclear deployment avoided excessive customization and focused on repeating a proven design, allowing for efficiency gains and predictable outcomes.

At present, there are various proposed reactor designs under consideration. Dutton’s proposal includes evaluating various reactor technologies, with a focus on South Korea’s APR1000 and APR1400 pressurized water reactors.

O’Brien has led a delegation to South Korea to study its nuclear power industry and assess the suitability of these reactor models for Australia.

It’s worth noting that while South Korea was successful in scaling nuclear generation, it did so with corruption that included substandard parts in reactors that led to a political scandal that resulted in the jailing of politicians and energy company executives.

Small modular nuclear reactors (SMR) have been proposed as part of the mix. They aren’t GW-scale and they don’t actually exist. As the Australian Academy of Technological Sciences and Engineering (ATSE) accurately pointed out in mid-2024, SMR technology remains in developmental stages globally, with no operational units in OECD countries.

The ATSE suggests that a mature market for SMRs may not emerge until the late 2040s, while I think it’s unlikely to emerge at all. Small reactors were tried in the 1960s and 1970s and were too expensive, leading to reactors being scaled up to around the GW scale in successful programs. There is nothing to indicate that anything has changed since then that will make SMRs successful and inexpensive the second time around.

Scale and speed mattered. Effective programs built between 24 and 100 reactors of very similar designs within a 20-to-40-year timeframe, ensuring that expertise remained within the workforce. Spreading projects over longer periods led to skill erosion and inefficiencies.

Dutton’s proposal has seven nuclear power plants, including five large-scale reactors and two SMRs. This isn’t critical mass for a nuclear program. As of February 2025, the United States operates 94 nuclear reactors, France has 57, and South Korea maintains 26 reactors. Those are sufficient numbers of GW-scale reactors to achieve program economies of scale. Australia’s peak electricity demand of 38.6 GW isn’t sufficient to provide an opportunity for sufficient numbers of reactors of a single design to be built.

Finally, strict adherence to design was non-negotiable. Countries that allowed constant innovation or design changes saw costs balloon and timelines slip. The lesson from history is clear: nuclear success depends on disciplined execution, a committed national strategy, and a workforce dedicated to repeating a single proven approach.

Australia’s strong engineering culture, known for innovation and adaptation, could pose challenges to a strictly controlled nuclear deployment program. Unlike industries where iterative improvements drive progress, nuclear power requires rigid standardization to control costs, ensure safety, and meet regulatory demands.

Australia’s history of engineering-led modifications – seen in mining, renewables, and infrastructure – could lead to pressures for design changes mid-project, a factor that has contributed to cost overruns and delays in nuclear projects overseas.

While flexibility has been a strength in other sectors, in nuclear energy, deviation from a single, proven reactor design undermines efficiency and drives up costs, making strict oversight and discipline crucial to success.

Could AI soon make dozens of billion-dollar nuclear stealth attack submarines more expensive and obsolete?

By Wayne Williams, 5 Jan 25, https://www.techradar.com/pro/could-ai-soon-make-dozens-of-billion-dollar-nuclear-stealth-attack-submarines-more-expensive-and-obsolete

Artificial intelligence can detect undersea movement better than humans.

AI can process far more data from a far more sensors than human operators can ever achieve

But the game of cat-and-mouse means that countermeasures do exist to confuse AI

Increase in compute performance and ubiquity of always-on passive sensors need also be accounted for.

The rise of AI is set to reduce the effectiveness of nuclear stealth attack submarines.

These advanced billion-dollar subs, designed to operate undetected in hostile waters, have long been at the forefront of naval defense. However, AI-driven advancements in sensor technology and data analysis are threatening their covert capabilities, potentially rendering them less effective.

An article by Foreign Policy and IEEE Spectrum now claims AI systems can process vast amounts of data from distributed sensor networks, far surpassing the capabilities of human operators. Quantum sensors, underwater surveillance arrays, and satellite-based imaging now collect detailed environmental data, while AI algorithms can identify even subtle anomalies, such as disturbances caused by submarines. Unlike human analysts, who might overlook minor patterns, AI excels at spotting these tiny shifts, increasing the effectiveness of detection systems.

Game of cat-and-mouse

AI’s increasing role could challenge the stealth of submarines like those in the Virginia-class, which rely on sophisticated engineering to minimize their detectable signatures.

Noise-dampening tiles, vibration-reducing materials, and pump-jet propulsors are designed to evade detection, but AI-enabled networks are increasingly adept at overcoming these methods. The ubiquity of passive sensors and continuous improvements in computational performance are increasing the reach and resolution of these detection systems, creating an environment of heightened transparency in the oceans.

Despite these advances, the game of cat-and-mouse persists, as countermeasures are, inevitably, being developed to outwit AI detection.

These tactics, as explored in the Foreign Policy and IEEE Spectrum piece, include noise-camouflaging techniques that mimic natural marine sounds, deploying uncrewed underwater vehicles (UUVs) to create diversions, and even cyberattacks aimed at corrupting the integrity of AI algorithms. Such methods seek to confuse and overwhelm AI systems, maintaining an edge in undersea warfare.

As AI technology evolves, nations will need to weigh up the escalating costs of nuclear stealth submarines against the potential for their obsolescence. Countermeasures may provide temporary degree of relief, but the increasing prevalence of passive sensors and AI-driven analysis suggests that traditional submarine stealth is likely to face diminishing returns in the long term.

Peter Dutton in his ignorance is pushing nuclear reactors in Australia – including small nuclear reactors

Helen Caldicott, 16 Dec 24

Here are the facts re SMRs.

Basically there are three types which generate less than 300 megawatts of electricity compared with

current day 1000 megawatt reactors.

- Light water reactors designs – these will be smaller versions of present-day pressurized water

reactors using water as the moderator and coolant but with the same attendant problems as

Fukushima and Three Mile Island. Built underground, they will be difficult to access in the event

of an accident or malfunction. - SMRs will be expensive because the cost per unit capacity increases with decrease in reactor size. Billions of dollars of government subsidies will be required because Wall Street is allergic to nuclear power. To alleviate costs, it is suggested that safety rules be relaxed including reducing security requirements and a reduction in the 10 mile emergency planning zone to 1000 feet.

SMRs will be expensive because the cost per unit capacity increases with decrease in reactor size.

Billions of dollars of government subsidies will be required because Wall Street is allergic to nuclear

power. To alleviate costs, it is suggested that safety rules be relaxed including reducing security

requirements and a reduction in the 10 mile emergency planning zone to 1000 feet.

- High-temperature gas cooled reactors HTGR or pebble bed reactors. Five billion tiny fuel kernels

consisting of high-enriched uranium or plutonium will be encased in tennis-ball-sized graphite

spheres which must be made without cracks or imperfections –or they could lead to an

accident. A total of 450,000 such spheres will slowly and continuously be released from a fuel

silo, passing through the reactor core, and then re-circulated ten times. These reactors will be

cooled by helium gas operating at high very temperatures (900 C).

A reactor complex consisting of four HTGR modules will be located underground, to be run by just two

operators in a central control room. Claims are that HTGRs will be so safe that a containment building

will be unnecessary and operators can even leave the site – “walk away safe” reactors.

However should temperatures unexpectedly exceed 1600 C the carbon coating will release dangerous

radioactive isotopes into the helium gas, and at 2000C the carbon would ignite creating a fierce graphite

Chernobyl-type fire.

If a crack develops in the piping or building, radioactive helium would escape, and air would rush in, also

igniting the graphite.

Although HTGRs produce small amounts of low level waste they create larger volumes of high level

waste than conventional reactors.

Despite these obvious safety problems and despite the fact that South Africa has abandoned plans for

HTGRs, the US Department of Energy has unwisely chosen the HTGR as the “Next Generation Nuclear

Plant”.

- Liquid metal fast reactors (PRISM)

It is claimed by proponents that fast reactors will be safe, economically competitive, proliferation

resistant, and sustainable.

Fueled by plutonium or highly enriched uranium, and cooled by either liquid sodium, or a lead-bismuth

molten coolant. Liquid sodium burns or explodes when exposed to air or water and lead-bismuth is

extremely corrosive producing very volatile radioactive elements when irradiated.

Should a crack occur in the reactor complex, liquid sodium would escape, burning or exploding. Without

coolant, the plutonium fuel could reach critical mass, triggering a massive nuclear explosion scattering

plutonium to the four winds. One millionth of a gram of plutonium induces cancer and it lasts for

500,000 years. Extraordinarily, claims are that fast reactors will be so safe they will require no

emergency sirens and emergency planning zones can be decreased from 10 miles to 1300 ft.

There are two types of fast reactors, a simple plutonium fueled reactor and a “breeder” in which the

plutonium reactor core is surrounded by a blanket of uranium 238 which captures neutrons and

converts to plutonium.

The plutonium fuel, obtained from spent reactor fuel will be fissioned and converted to shorter lived

isotopes – cesium and strontium which last 600 years instead of 500,000. Called “transmutation”, the

industry claims that this is an excellent way to get rid of plutonium waste. But this is fallacious, because

only 10% fissions leaving 90% of the plutonium for bomb making etc.

Construction. Three small plutonium fast reactors will be grouped together to form a module and three

of these modules will be buried underground. All nine reactors will then be connected to a fully

automated central control room operated by only three operators. Potentially then, one operator could

simultaneously face a catastrophic situation triggered by loss of off-site power to one unit at full power,

in another shut down for refueling and one in start-up mode. There are to be no emergency core cooling

systems.

Fast reactors require a massive infrastructure including a reprocessing plant to dissolve radioactive

waste fuel rods in nitric acid, chemically removing the plutonium and a fuel fabrication facility to create

new fuel rods. A total of 10,160 kilos of plutonium is required to operate a fuel cycle at a fast reactor

and just 2.5 kilos is fuel for a nuclear weapon.

Thus fast reactors and breeders will provide extraordinary long-term medical dangers and the perfect

situation for nuclear weapons proliferation. Despite this, the industry is clearly trying to market them to

many countries including it seems, Australia.

The question of nuclear in Australia’s electricity sector

https://www.csiro.au/en/news/All/Articles/2024/December/Nuclear-explainer 9 Dec 24

In Australia’s transition to net zero emissions, the electricity sector has a major role to play. But does nuclear power have a place in our future grid?

Key points

While nuclear technologies have a long operational life, this factor provides no unique cost advantage over shorter-lived technologies.

Nuclear power does not currently provide the most cost competitive solution for low emission electricity in Australia.

Long development lead times mean nuclear won’t be able to make a significant contribution to achieving net zero emissions by 2050.

This explainer was updated on 09 December 2024 to reflect costings included in the draft GenCost 2024-25 Report.

As Australia works towards emissions reduction targets in the transition to net zero, we know the electricity sector has a major role to play. We also know it makes sense to assess a full range of technologies: some new and emerging, some established and proven.

In this context some proponents want nuclear to be considered as an option for decarbonising the electricity sector.

Despite nuclear power being a component of electricity generation for 16 per cent of the world’s countries, it does not currently represent a timely or efficient solution for meeting Australia’s net zero target.

Here’s why:

- Nuclear is not economically competitive with solar PV and wind and the total development time in Australia for large or small-scale nuclear is at least 15 years.

- Small modular reactors (SMRs) are potentially faster to build but are commercially immature at present.

- The total development lead time needed for nuclear means it cannot play a major role in electricity sector emission abatement, which is more urgent than abatement in other sectors.

Understanding GenCost calculations

GenCost is a leading economic report by CSIRO in collaboration with the Australian Energy Market Operator (AEMO) to estimate the cost of building future electricity generation and storage, as well as hydrogen production in Australia.

It is a policy and technology neutral report and the annual process involves close collaboration with electricity industry experts. There are opportunities for stakeholders to provide pre-publication feedback, ensuring the accuracy of available evidence.

Paul Graham, our Chief Energy Economist and lead author of the report, said GenCost is an open and public process.

“The report’s data is not just for AEMO planning and forecasting; it’s also used by government policymakers and electricity strategists who require a clear, simple metric to inform their decisions,” Paul said.

“To facilitate a straightforward comparison across different technologies, the GenCost report conducts a levelised cost of electricity analysis. This method calculates a dollar cost per megawatt hour (MWh) over the economic life of the asset, incorporating initial capital expenses and any ongoing fuel, operation, and maintenance costs.”

The draft GenCost 2024-25 Report released on 09 December 2024 found renewables continue to have the lowest cost range of any new build electricity generation technologies.

[Excellent table here -on original]

One of the factors that impacts the high and low cost range is the capacity factor. The capacity factor is the percentage of time on average that the technology generates to its full capacity throughout the year. Costs are lowest if technologies. such as nuclear, can operate at full capacity for as long as possible so they have more generation revenue over which to recover their capital costs.

Nuclear technology is capable of high capacity factor operation but globally its capacity factor ranges from below 60% to above 90% with an average of 80%. Australia operates a similar steam turbine based technology in coal generation for which the average capacity factor over the last decade was 59% with a maximum of 89%.

The shape of the electricity load and competition from other sources is very different between countries and so our preference is to always use Australian data where it is available. Consequently, we apply the historical coal capacity factors when considering the potential future capacity factors of Australian nuclear generation.

Capital cost assumptions

While nuclear generation is well established globally, it has never been deployed in Australia.

Applying overseas costs to large-scale nuclear projects in Australia is not straightforward due to significant variations in labour costs, workforce expertise, governance and standards. As a result, the source country for large-scale nuclear data must be carefully selected.

GenCost estimates of the cost large-scale nuclear are based on South Korea’s successful continuous nuclear building program and adjusted for differences in Australian and South Korean deployment costs by investigating the ratio of new coal generation costs in each country.

The large-scale nuclear costs it reported could only be achieved if Australia commits to a continuous building program, following the construction of an initial higher-cost unit or units. Initial units of all first-of-a-kind technologies in Australia are expected to be impacted by higher costs. A first-of-a-kind cost premium of up to 100 per cent cannot be ruled out. These assumptions remain for the draft GenCost 2024-25 Report.

Life of the investment

GenCost recognises the difference between the period over which the capital cost is recovered (the economic life) and operational life of an asset.

GenCost assumes a 30-year economic life for large-scale nuclear plants, even though they can operate for a longer period. It is standard practice in private financing that the capital recovery period for an asset is less than its full operational life, similar to a car or house loan. For power stations, warranties expire and refurbishment costs may begin to fall around the 30-year mark. As a result, we use a 30-year lifespan in our cost calculations.

After the final GenCost 23-24 Report was released in May 2024, nuclear proponents clarified they will seek to achieve longer capital recovery periods, closer to the operational life, by using public financing to realise potential cost advantages.

The draft GenCost 2024-25 Report has calculated those cost advantages for the first time (using a 60-year period), finding that there are no unique cost advantages arising from nuclear technology’s long operational life. Similar cost savings are achievable from shorter-lived technologies, even accounting for the fact that shorter lived technologies need to be built twice. This is because shorter-lived technologies such as solar PV and wind are typically available at a lower cost over time, making the second build less costly.

The lack of an economic advantage for long-lived nuclear is due to substantial nuclear refurbishment costs to achieve long operational life safely. Without new investment it cannot achieve long operational life. Also, because of the long lead time in nuclear deployment, cost reductions in the second half of their operational life are not available until around 45 years into the future, significantly reducing their value to consumers compared to other options.

Current figures for Small Modular Reactors (SMRs)

The Carbon Free Power Project was a nuclear SMR project in the United States established in 2015 and planned for full operation by 2030. It was the first project to receive design certification from the Nuclear Regulatory Commission, an essential step before construction can commence. In November 2023, the project was cancelled following a 56 per cent increase in reported costs.

Despite being cancelled, this project was the first and currently remains the only project to have provided cost estimates for a real commercial venture with detailed data. Until now, most sources were for theoretical projects only.

“The main area of uncertainty with nuclear SMR has been around capital costs,” Paul said.

“The Carbon Free Power Project provided more confidence about the capital costs of nuclear SMR and the data confirms it is currently a very high-cost technology.”

“We don’t disagree with the principle of SMRs. They attempt to speed up the building process of nuclear plants using standardised components in a modular system and may achieve cost reductions over time. However, the lack of commercial deployment has meant that these potential savings are not yet verified or realised,” Paul said.

Time is running out for the energy transition

Nuclear power has an empty development pipeline in Australia. Given the state and federal legal restrictions, this is not surprising.

But even if nuclear power was more economically feasible, its slow construction and its additional pre-construction steps, particularly around safety and security, limit its potential to play a serious role in reducing emissions within the required timeframe.

In the last five years, the global median construction time for nuclear has been 8.2 years. Furthermore, in the last ten years, no country with a similar level of democracy to Australia have been able to complete construction in less than 10 years. Overall, it will take at least 15 years before first nuclear generation could be achieved in Australia.

“The electricity sector is one of our largest sources of emissions and delaying the transition will make the cost of addressing climate change higher for all Australians,” Paul said

The electricity sector must rapidly lead the transition to net zero, so other sectors like transport, building and manufacturing can adopt electrification and cut their emissions.”

How close are we to chaos? It turns out, just one blue screen of death

Keeping cash as a backup is a smart idea in the event of a payment systems outage,

David Swan, Technology editor, 22 July 24, https://www.theage.com.au/technology/how-close-are-we-to-chaos-it-turns-out-just-one-blue-screen-of-death-20240720-p5jv6t.html

In some places, Friday’s mass tech outage resembled the beginning of an apocalyptic zombie movie. Supermarket checkouts were felled across the country and shoppers were turned away, airports became shelters for stranded passengers, and live TV and radio presenters were left scrambling to fill airtime. The iconic Windows “blue screen of death” hit millions of devices globally and rendered them effectively useless.

The ABC’s national youth station Triple J issued a call-out for anyone who could come to their Sydney studio to DJ in person. One woman was reportedly unable to open her smart fridge to access her food.

All because of a failure at CrowdStrike, a company that most of us – least of all those who were worst hit – had never heard of before.

It’s thought to be the worst tech outage in history and Australia was at its epicentre: the crisis began here, and spread to Europe and the US as the day progressed. Surgeries were cancelled in Austria, Japanese airlines cancelled flights and Indian banks were knocked offline. It was a horrifying demonstration of how interconnected global technology is, and how quickly things can fall apart.

At its peak, it reminded us of some of the most stressful periods of the pandemic, when shoppers fought each other for rolls of toilet paper and argued about whether they needed to wear masks.

Many of us lived through the Y2K panic. We avoided the worst outcomes but it was an early harbinger of how vulnerable our technology is to bugs and faults, and showed the work required to keep everything up and running. The CrowdStrike meltdown felt closer to what’s really at risk when things go wrong.

As a technology reporter, for years I’ve had warnings from industry executives of the danger of cyberattacks or mass outages. These warnings have become real.

The cause of this outage was not anything malicious. It was relatively innocuous: CrowdStrike has blamed a faulty update from its security software, which then caused millions of Windows machines to crash and enter a recovery boot loop.

Of course Australians are no strangers to mass outages, even as they become more common and more severe.

The Optus network outage that froze train networks and disrupted hospital services just over six months ago was eerily similar to the events on Friday, not least because it was also caused by what was supposed to be a routine software upgrade.

The resignation of chief executive Kelly Bayer Rosmarin did little to prevent another Optus outage a month later. If anything, Friday’s CrowdStrike outage highlights how many opportunities there are for one failure to cripple millions of devices and grind the global economy to a halt. So many of the devices that underpin our economy have hundreds of different ways that they can be knocked offline, whether through a cyberattack or human error, as was likely the case with CrowdStrike.

The incident would likely have been even worse were it a cyberattack. Experts have long warned about the vulnerability of critical infrastructure – including water supplies and electricity – to malicious hackers. Everything is now connected to the internet and is therefore at risk.

And yet the potential damage of such attacks is only growing. We are now more reliant than ever on a concentrated number of software firms, and we have repeatedly seen their products come up short when we need them to just work.

In the US, the chair of the Federal Trade Commission, Lina Khan, put it succinctly.

“All too often these days, a single glitch results in a system-wide outage, affecting industries from healthcare and airlines to banks and auto-dealers,” Khan said on Saturday.

“Millions of people and businesses pay the price.”

Khan is right. The technology we rely on is increasingly fragile, and is increasingly in the hands of just a few companies. The world’s tech giants like Microsoft and Apple now effectively run our daily lives and businesses, and an update containing a small human error can knock it all over, from Australia to India.

The heat is now on CrowdStrike, as well as the broader technology sector on which we rely so heavily, and some initial lessons are clear. Airlines have backup systems to help keep some flights operational in the case of a technological malfunction. As everyday citizens, it’s an unfortunate reality that we need to think similarly.

Keeping cash as a backup is a smart idea in the event of a payment systems outage, as is having spare battery packs for your devices. Many smart modems these days, like those from Telstra and Optus, offer 4G or 5G internet if their main connection goes down. We need more redundancies built in to the technology we use, and more alternatives in case the technology stops working altogether.

For IT executives at supermarkets, banks and hospitals, the outage makes it clear that “business as usual” will no longer cut it, and customers rightly should expect adequate backups to be in place. Before the Optus outage, a sense of complacency had permeated our IT operations rooms and our company boardrooms, and it still remains. No longer.

The “blue screen of death”, accompanied by a frowny face, was an apt metaphor for the current state of play when it comes to our overreliance on technology. Our technology companies – and us consumers, too – need to do things differently if we’re to avoid another catastrophic global IT outage. There’s too much at stake not to.

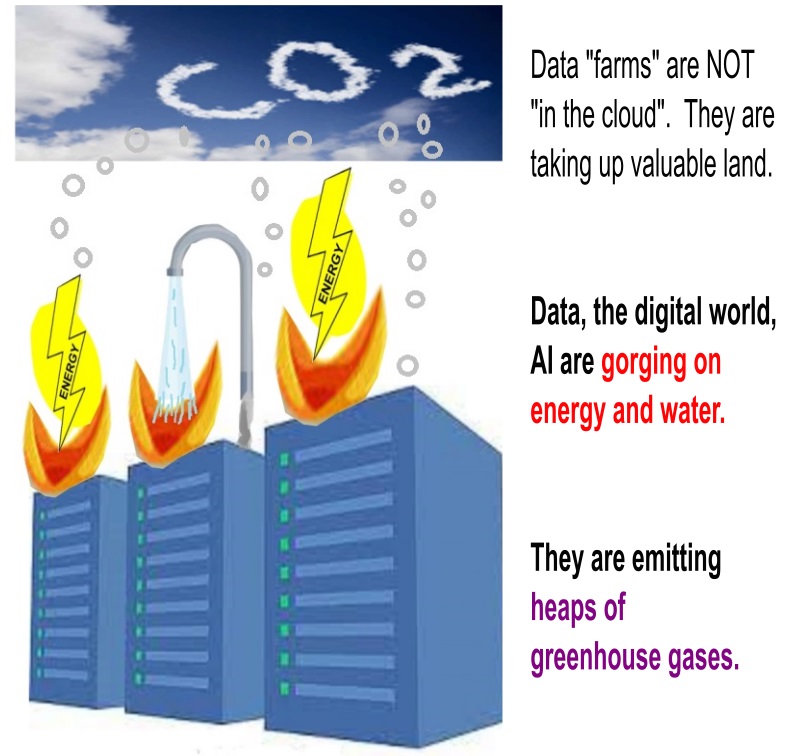

Power-hungry data centres are booming in Australia. Can the grid cope?

By Nick Toscano, July 12, 2024, https://www.theage.com.au/business/companies/power-hungry-data-centres-are-booming-in-australia-can-the-grid-cope-20240711-p5jssa.html

An explosion in the number of data centres in Australia is looming as a new test for the energy grid amid warnings they might soon require as much as electricity as two giant coal-fired power stations are capable of generating.

As cloud-based computing [nb there is no “cloud”] and artificial intelligence (AI) accelerate demand for data storage, Melbourne and Sydney have emerged as key locations for tech companies building vast industrial facilities to house their servers that send and receive data 24/7, known as data centres.

These data centres, which need huge amounts of electricity to run high-intensity computing and cooling systems, are already major power users in Australia – consuming about 5 per cent of available generation.

They are expected to drive further electricity demand growth alongside homes switching from gas to electric appliances and the growing adoption of electric cars.

However, new modelling from UBS suggests official forecasts may be underestimating the scale of the added demand that data centres could drive in the coming years.

The investment bank calculates between 3.3 gigawatts and 5 gigawatts of demand – equivalent to the combined generating potential of approximately two of Australia’s biggest coal-fired power plants – could be added to the east coast grid by 2030 on the back of growth in data centres and artificial intelligence.

At the top end of the range that could equate to up to 15 per cent of overall grid demand, which could add significant strain to supplies and push up prices unless properly managed.

The data centre boom is coming at a time of upheaval for Australia’s main grid as it transitions to cleaner energy, while the coal plants that have supplied the bulk of its power for decades increasingly bring forward their closures.

Although renewables’ share of the mix is growing, there are worries it’s not happening fast enough, with authorities fearing a shortfall of generation, storage and transmission lines to protect against the threat of price rises or blackouts once coal exits the grid.

Analysts at Morgan Stanley believe the grid will be able to accommodate extra demand from data centres’ growth, which it forecasts to rise from 5 per cent to about 8 per cent by 2030.

However, the system will face more strain next decade when the majority of the nation’s remaining coal-fired power plants are expected to have closed, they said.

“We see the power requirement for new Australian data centres as manageable for the Australian power system to 2030, but power could become a constraint in the 2030s given planned coal plant closures,” they said.

UBS said data centres may provide benefits for grid planners trying to maintain system stability, given they offer consistent minimum demand 24/7 – similar to the role of aluminium smelters. But they would add “incremental pressure” during evening peak demand periods once the sun sets and solar output recedes, Allen said.

The spread between daytime and evening wholesale prices could widen to up to 70 per cent by 2030 due to coal closures and delays to the renewable rollout, he added.

Nuclear engineer dismisses Peter Dutton’s claim that small modular reactors could be commercially viable soon

Hugh Durrant-Whyte says 2045 is a realistic timeframe, adding it was likely to be ‘more expensive than anything else you could possibly think of’

Peter Hannam, Fri 21 Jun 2024, https://www.theguardian.com/australia-news/article/2024/jun/21/peter-dutton-coalition-nuclear-policy-engineer-small-modular-reactors-no-commercially-viable

Australia would need “many decades” to develop the regulations and skills to operate a nuclear power plant, and the experience gained at the existing Lucas Heights facility won’t help much, according to New South Wales’ chief scientist and engineer.

Hugh Durrant-Whyte said he stood by comments made to a 2019 NSW upper house inquiry into uranium mining and nuclear facilities that running a plant and its fuel supply chain would require skills “built up over many decades”.

Stressing he spoke in the capacity of a trained nuclear engineer rather than as the state’s chief scientist, Durrant-Whyte said the industry demanded regulations and monitoring for all stages of fuel handling, power generation and waste management.

He told Guardian Australia that 2040 or even 2045 was the “realistic” timeframe.

“We would need people who were trained [on] how to measure radioactivity, how to measure containment vessel strengths, how to [manage] everything we do.”

The federal opposition on Wednesday revealed plans to build seven nuclear power stations in five states at existing coal plant sites, promising the first could be operating by the mid-2030s.

The government would own the plants and compulsorily acquire the sites if the owners – private companies as well as the Queensland and Western Australian governments – declined to sell them.

The shadow energy spokesperson, Ted O’Brien, has cited France and Canada as examples Australia could follow. He also offered the example of Lucas Heights, located in Sydney’s south, where a small reactor has been used for medical research for decades.

Durrant-Whyte said Canada’s nuclear industry employed about 30,000 people while France’s employed 125,000 – “not a trivial number of people”.

The UK, which operated nuclear plants for many years, has just one nuclear engineering program at an undergraduate level, limiting the supply of talent that could be imported from there.

He was also dismissive of the prospect that small modular reactors – which the opposition proposes to start its nuclear program with – were likely to be commercially viable soon.

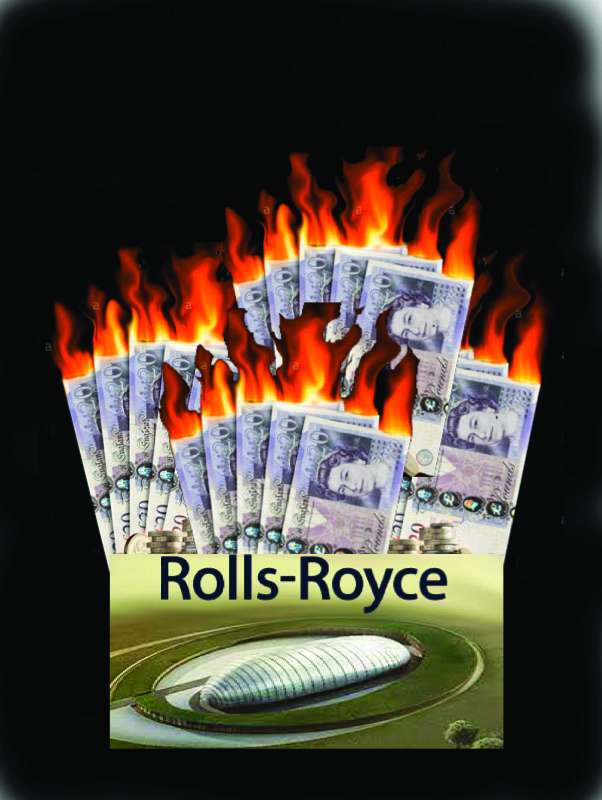

“When I was [at Rolls-Royce] in 1979 my colleagues in the couple of desks next to me were designing SMRs,” he said. “It’s always the issue with anything big and complex. Whether it’s an aeroplane or a nuclear reactor, the first one is always the hardest.”

The capabilities learned at the Lucas Heights Ansto (Australian Nuclear Science and Technology Organisation) facility would make “little contribution” to supporting a nuclear power industry in the country, he wrote in his 2019 report.

“It must be recognised that this is a ‘zero-power’ pool reactor where the complexities of high pressure, high power, high radiation environments do not exist.”

Similarly, the capabilities needed to manage nuclear-powered submarines as part of the Aukus program also offered few transferrable skills. The pressurised water reactors on the submarines would be, in effect, SMRs of a 100-200 megawatt capacity size.

“My suspicion is we will buy the reactors in a piece of submarine and assemble that piece into submarines here,” Durrant-Whyte said. “But even then, let’s be clear, we’re not going to be doing that until the mid-2040s.”

As for safety, he said nuclear reactors were designed to be “very, very safe”. But there “have been a lot of accidents because of fuel handling and things like that” as a result of human error.

“It’s not like we haven’t had this [nuclear] conversation many times over the last 20 years in Australia,” Durrant-Whyte said. “It would be expensive, and likely more expensive than anything else you could possibly think of.”

Dutton’s plan to build nuclear plants on former coal sites not as easy as it seems

Dr Katherine Woodthorpe said it would be impractical for nuclear facilities to use existing poles and wires. CREDIT:LOUIE DOUVIS

By Bianca Hall, June 21, 2024, https://www.theage.com.au/environment/climate-change/dutton-s-plan-to-build-nuclear-plants-on-former-coal-sites-not-as-easy-as-it-seems-20240620-p5jnbo.html